Calculating capital gain on depreciable property

Capital Gain Usually you will have a capital gain on depreciable property if you sell it for more than its adjusted cost base plus the outlays and expenses incurred to sell the property. Computation of capital gains in the case of transfer of land and building Sec.

Capital Gains On Depreciable Assets Income From Capital Gains Ipcc Youtube

When you sell property the profits earned are known as capital gains.

. You have to take into account the depreciation deductions youve claimed on an asset in calculating the amount of capital gain. Ordinary losses that are not attributable to depreciation also offset capital gains on other property or investments that you sell in the same year. 2 weeks agoSubtract your adjusted basis from your selling price to determine your total capital gain.

Long Term capital gains from property is taxed at flat rate of 20 after. Capital gains in case of depreciable assets. In this example subtract 900000 from 14 million to get a 500000 capital gain.

According to section 50 of Income tax act if an assessee has sold a capital asset forming part of block of assets building machinery etc on. So if the depreciation is affecting the cost base of your property so its what you paid for it minus your expenses. 50C- Section 50C is applicable if the following conditions are satisfied- 1.

The original purchase price of the asset minus all accumulated depreciation and any accumulated impairment charges is the carrying value of the asset. To recap capital gains is capital proceeds minus the cost base. POD exceeding the ACB of the property results in a capital gain equal to the amount.

If you sell some residential real estate. A BMT Tax Depreciation Schedule covers all deductions available over the lifetime of a property and provides accountants with the necessary information to calculate capital. Case 1 - If depreciable property is sold for POD greater than the ACB of the asset the following occurs.

Per the Income Tax Act 1961 you have to pay a capital gains tax on sale of property. He subtracts 8000 the lesser of the proceeds of disposition of the property minus the related outlays and expenses. There is a transfer of land.

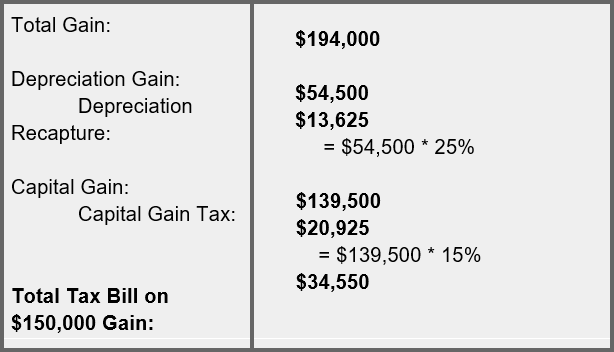

In this situation the UCC is also 6000 10000 - 4000. Well your cost price of 200000 included the building value and youve depreciated that building value by 50000 so your cost base is now 150000 200000 50000 claimed. You have to take into account the depreciation deductions youve claimed on an asset in calculating the amount of capital gain or loss on its sale.

Calculation of capital gain where all the assets of the block are transferred. Capital Gains Tax Calculation Proceeds of Disposition - Adjusted Cost Base Total Capital Gain Total Capital Gain 50 Inclusion Rate Taxable Capital Gain Taxable Capital. However there are a few exceptions to this rule like gain on depreciable asset is always.

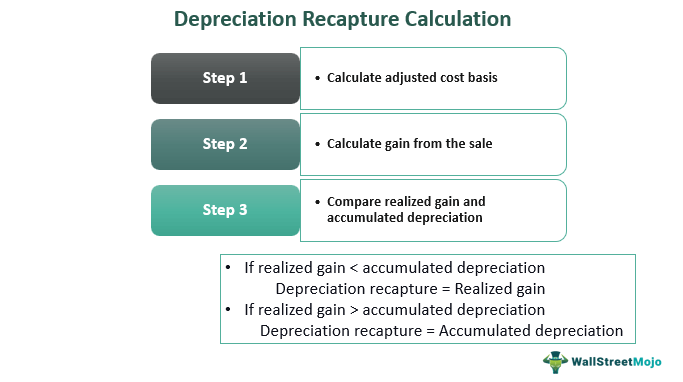

You can have a Capital gain on depreciable property if you sell it for more than its adjusted cost base plus the outlays and expenses incurred to sell the property Canada Revenue Agency. A capital gains tax CGT is a tax on the profit realized on the sale of a non-inventory assetThe most common capital gains are realized from the sale of stocks bonds. Depreciation recapture is the gain realized by the sale of depreciable capital property.

How do you calculate capital gainslosses on depreciation. The unrecaptured section 1250 gain can be calculated as 10000 x 11 110000 and the capital gain on the property is 265000 - 10000 x 11 155000. If the whole of the block of asset is sold and the sale consideration is less than the written down value opening.

Financial Accounting Depreciation Calculation Fixed Assets Codecademy Fixed Asset Financial Accounting Udemy Coupon

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Depreciation Recapture Meaning Calculation Tax Rate Example

Ca Ipcc Pgbp 24 Capital Gains Arising In Respect Of Depreciable Assets Section 50 Youtube

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Pin On Accounting

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Learn About Depreciation Recapture Spartan Invest

Depreciation Of Building Definition Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Depreciation Bookkeeping Business Accounting Education Accounting Basics

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Depreciation Recapture Cost Segregation

Depreciation Turns Capital Expenditures Into Expenses Over Time Income Statement Income Cost Accounting

1031 Exchange And Depreciation Recapture Explained A To Z Propertycashin

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker